Government bonds, often referred to as sovereign bonds or simply “gilts,” are debt securities issued by a government to raise capital. This article provides an overview of government bonds, detailing what they are, the process of purchasing them, their yield, and a comparison with Treasury bills.

What Are Government Bonds?

Government bonds represent a form of debt where investors lend money to a government in exchange for periodic interest payments and the return of the principal amount at maturity. These bonds are considered low-risk investments, particularly when issued by economically stable governments.

How to Purchase Government Bonds:

- Primary Market:

- Investors can purchase government bonds directly from the government when they are initially issued through auctions or other issuance methods.

- Secondary Market:

- Government bonds are actively traded on the secondary market, allowing investors to buy and sell bonds after their initial issuance. Brokerage firms facilitate these transactions.

- Financial Institutions:

- Many financial institutions, including banks and investment firms, offer government bonds to individual investors.

Yield on Government Bonds:

- Coupon Payments:

- Government bonds pay periodic interest, known as coupon payments, typically semi-annually. The yield is calculated as a percentage of the bond’s face value.

- Current Yield:

- The current yield is a measure of the bond’s annual interest payment relative to its current market price. It provides an indication of the immediate return on investment.

- Yield to Maturity (YTM):

- YTM reflects the total return an investor can expect if the bond is held until maturity, considering both coupon payments and changes in the bond’s market price.

Comparison with Treasury Bills:

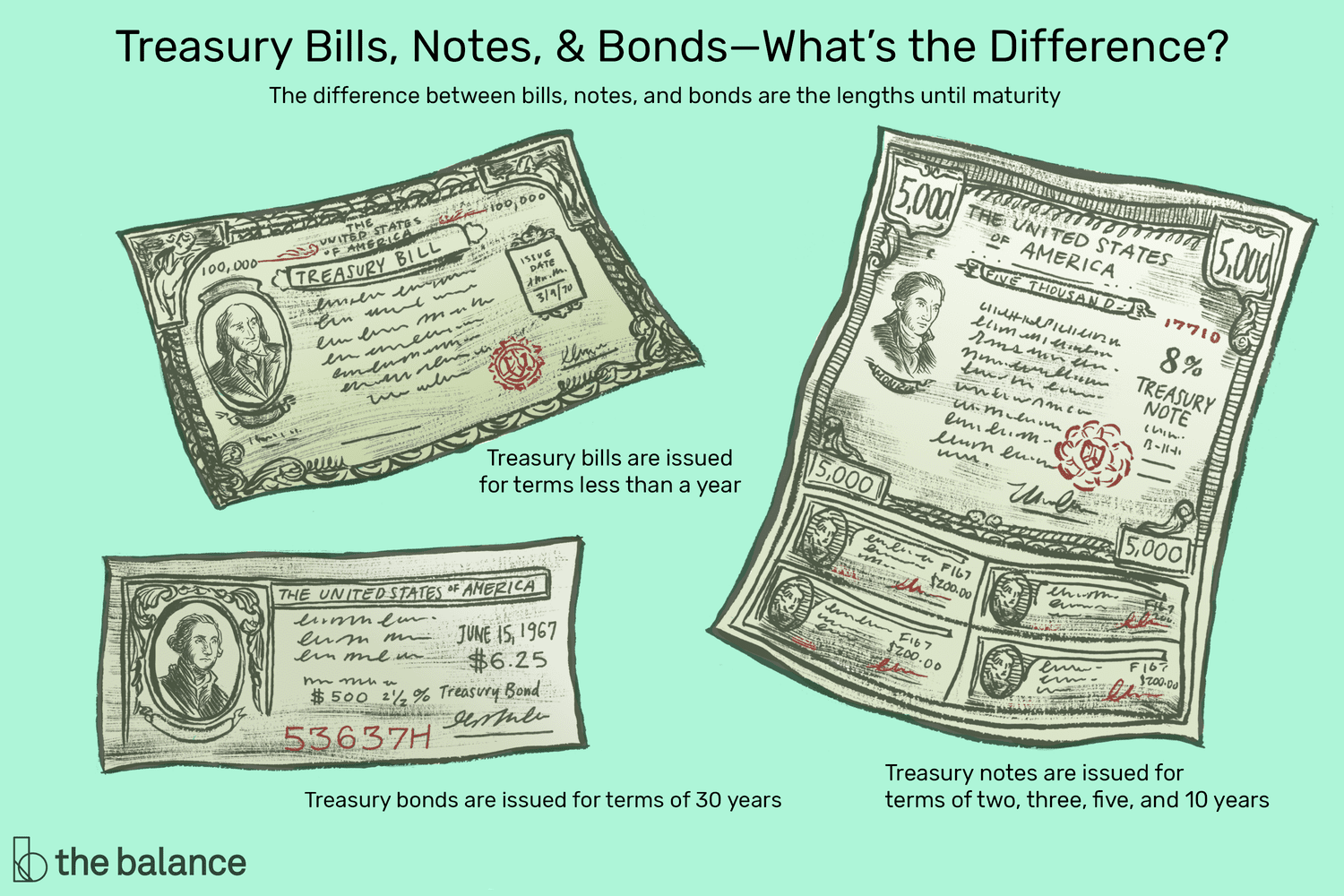

- Maturity Period:

- Government bonds generally have longer maturity periods, ranging from several years to decades, while Treasury bills have shorter maturities, often less than one year.

- Interest Payments:

- Bonds pay periodic interest, whereas Treasury bills are sold at a discount and do not make interest payments. Investors earn a return through the difference between the purchase price and the face value at maturity.

- Market Price Volatility:

- Bonds may experience greater price volatility in the secondary market compared to Treasury bills, which are less sensitive to interest rate changes due to their short-term nature.

- Risk and Return:

- Bonds are considered to carry slightly higher risk compared to Treasury bills due to the longer time to maturity. However, they also offer the potential for higher returns.

Conclusion:

Government bonds serve as essential components in the investment landscape, providing investors with a secure avenue for capital preservation and income generation. Understanding how to purchase government bonds, evaluating their yield, and comparing them to Treasury bills empower investors to make informed decisions aligning with their financial objectives. As with any investment, thorough research and consideration of individual financial goals are crucial when venturing into the realm of government bonds.