A bill of exchange, often referred to as a draft, is a fundamental financial instrument that plays a pivotal role in facilitating trade and commerce globally. This article aims to elucidate the concept of a bill of exchange and outline its distinctive characteristics.

Definition:

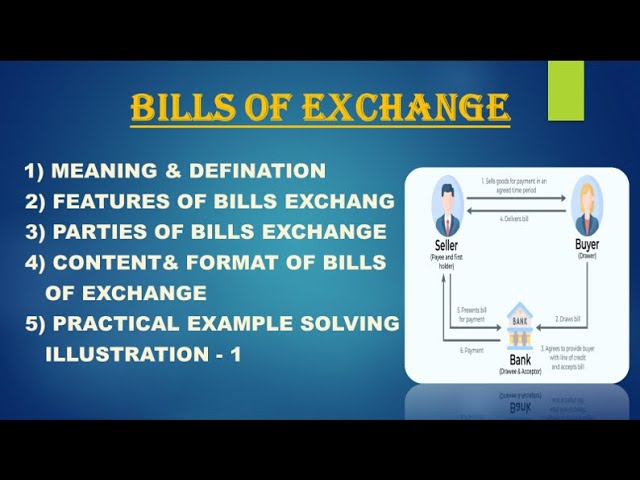

A bill of exchange is a negotiable instrument that represents an unconditional order in writing, typically from the seller (drawer) to the buyer (drawee), directing the latter to pay a specified sum to a third party, known as the payee. This financial document serves as a legally binding agreement for the exchange of goods and services.

Key Characteristics:

- Negotiability:

- One of the defining features of a bill of exchange is its negotiability. It can be transferred or endorsed to another party, providing flexibility in its use and ensuring the smooth flow of trade.

- Unconditional Order:

- The order contained in a bill of exchange is unconditional, meaning that the payment is not contingent upon any additional conditions. This clarity enhances the security and enforceability of the instrument.

- Three Key Parties:

- A bill of exchange involves three primary parties: the drawer (seller/exporter), the drawee (buyer/importer), and the payee (entity to whom payment is directed, often a bank).

- Specified Sum:

- The bill specifies the exact amount that the drawee is obligated to pay. This amount is often expressed in the currency of the transaction.

- Maturity Date:

- Bills of exchange have a predetermined maturity date, indicating when the payment is due. This date is agreed upon by the parties involved and is crucial for the timing of the financial transaction.

- Payment Assurance:

- For the seller, a bill of exchange provides assurance of payment from the buyer, offering a degree of security in international or domestic trade transactions.

- Trade Facilitation:

- Bills of exchange are instrumental in facilitating trade by streamlining payment processes. They help overcome challenges related to credit terms and uncertainties in cross-border transactions.

- Discounting Option:

- The drawer has the option to discount the bill with a financial institution before the maturity date. This involves selling the bill at a discounted value in exchange for immediate cash.

Use Cases:

- International Trade:

- Bills of exchange are extensively used in international trade to ensure smooth and secure transactions between parties in different countries.

- Credit Transactions:

- In credit transactions, where the buyer may not make an immediate payment, a bill of exchange provides a mechanism for deferred payment.

- Trade Financing:

- Bills of exchange play a crucial role in trade financing, allowing businesses to access funds by discounting the bill with banks or financial institutions.

Conclusion:

In essence, a bill of exchange serves as a linchpin in the world of trade and finance, offering a reliable and standardized mechanism for ensuring payment and facilitating commerce. Its negotiability, clarity of terms, and adaptability make it a cornerstone in various financial transactions, contributing to the smooth functioning of domestic and international trade. Understanding the characteristics of a bill of exchange is fundamental for businesses engaged in commerce, providing them with a powerful tool to navigate the complexities of modern trade.