In the world of fixed-income securities, Zero-Coupon Bonds stand out as unique instruments that offer investors an alternative path to capital appreciation. This guide provides a comprehensive look at Zero-Coupon Bonds, exploring their definition, operational mechanisms, and the methods used to calculate their value.

Understanding Zero-Coupon Bonds:

Definition: Zero-Coupon Bonds, often referred to as zeroes or deep discount bonds, are debt instruments that do not make periodic interest payments like traditional bonds. Instead, they are issued at a significant discount to their face value and mature at that face value, generating a profit for the investor upon maturity.

Key Features:

- No Periodic Interest Payments:

- Unlike conventional bonds that pay periodic interest, zero-coupon bonds do not distribute interest during their term. Instead, investors receive their return through the difference between the purchase price and the face value at maturity.

- Issued at a Discount:

- Zero-coupon bonds are typically issued at a substantial discount to their face value. The difference between the purchase price and the face value represents the implied interest that accrues over the bond’s life.

- Maturity Appreciation:

- The value of zero-coupon bonds appreciates over time as they approach maturity. Investors gain a return by holding the bond until maturity and receiving the full face value.

Operation of Zero-Coupon Bonds:

- Issuance at Discount:

- Zero-coupon bonds are initially issued at a discount, often reflecting prevailing interest rates. The discount rate is determined based on market conditions, time to maturity, and the perceived creditworthiness of the issuer.

- Accrual of Interest:

- While zero-coupon bonds do not make regular interest payments, interest is effectively accrued and compounded over the life of the bond. The difference between the purchase price and the face value represents this accrued interest.

- Maturity Redemption:

- At maturity, zero-coupon bonds are redeemed at their face value. The investor realizes a gain by receiving the full face value despite having initially paid a lower price.

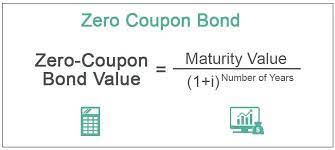

Calculation Methods:

- Yield to Maturity (YTM):

- YTM is a common metric used to calculate the annualized rate of return an investor can expect if the zero-coupon bond is held until maturity. It considers the purchase price, face value, and time to maturity.

���=(��)1�−1

where � is the face value, � is the purchase price, and � is the number of years to maturity.

- Current Yield:

- Current yield is another measure that expresses the annual income generated by the bond as a percentage of its current market price.

������������=��������������������������������×100%

Conclusion:

Zero-Coupon Bonds offer a distinctive investment avenue for those seeking capital appreciation without the need for regular interest income. By understanding their features, operational mechanics, and calculation methods, investors can incorporate zero-coupon bonds strategically into their portfolios, aligning with their investment goals and risk preferences.